Complete coverage auto insurance policy is a term that describes having every one of the primary parts of vehicle insurance coverage including Bodily Injury, Property Damages, Without Insurance Driver, PIP, Crash and Comprehensive. insured car. You're usually legitimately required to bring about half of those coverages. Having the entire bundle is called "Complete Protection", and also some individuals choose it to get better monetary protection.

Tabulation Very first component of complete coverage: responsibility insurance Obligation insurance coverage covers problems you are at fault for and also trigger to one more motorist or their auto. It is the only part of automobile insurance policy that you are required by regulation to carry. Within responsibility, both primary kinds of insurance coverage are Helpful hints as well as obligation insurance - perks.

cheapest affordable car insurance auto vehicle insurance

cheapest affordable car insurance auto vehicle insurance

Neither insurance coverage is indicated to shield you or your car; they are specifically for other chauffeurs to sue versus your insurer. As an example, if you got injured in a crash, and also called for surgical procedure, you would certainly have to submit via the various other vehicle driver's BI insurance to spend for the surgical treatment instead of your own BI insurance coverage (insurance companies).

prices cheap car affordable auto insurance perks

prices cheap car affordable auto insurance perks

Each state institutes a state minimum, which is created in a three number format like 25/50/25. affordable car insurance. The very first two numbers describe your BI protection, where the very first is the limit of insurance coverage you have for a single person in a crash, while the 2nd is the restriction for the entire crash (vehicle).

In some states, you are called for to bring some variant of these 2 coverages, while it is optional in others. The amount you carry normally mirrors the amount of BI and also PD you carry. credit score. As well, some states might just require you have the BI version of Uninsured Driver protection, instead of both BI and PD.

All About Liability Vs. Full-coverage Car Insurance Comparison - Forbes

This makes as well as UIM insurance coverage usually the most inexpensive element of "complete protection". 2nd component of full protection: first-party benefits Within first-party benefits are several types of insurance coverage which constitute the second part of "full protection". For a lot of states, first-party benefits insurance coverage is optional to lug. It is additionally generally extra expensive, but its biggest advantage is that you can use it for your very own damages as well as medical expenses much faster - suvs.

If you were injured in an auto accident, instead of requiring to file with the other motorist's BI insurance coverage, you can submit via your very own PIP to spend for your clinical expenditures. The main benefit to PIP is that it pays no matter who was at fault - cars. PIP has a tendency to overlap typically with your very own medical insurance, and normally works as a beneficial complement as well as provides extra defense.

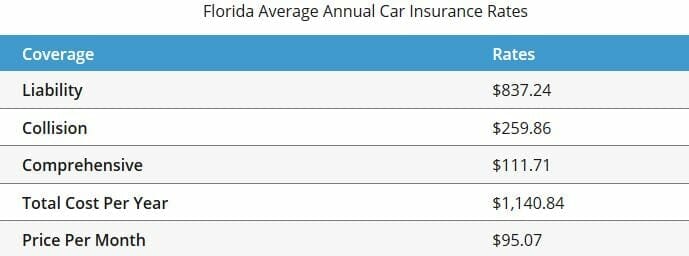

The states where PIP is compulsory generally make those states much more expensive for automobile insurance coverage - suvs. In Florida, you could anticipate to pay an added $25 to $90 per year for PIP, though it needs to be kept in mind that consist of among the most affordable restrictions for PIP among the states where PIP is called for. insured car.

low-cost auto insurance perks vehicle insurance low cost auto

low-cost auto insurance perks vehicle insurance low cost auto

In Michigan, for instance, when state legislations required chauffeurs to bring unlimited PIP, prices may surpass $4,000 annually. Medication, Pay is basically the very same point as PIP insurance coverage, other than that it is not necessary in any state. Medication, Pay is a mainly repetitive coverage in "no-fault" states however can be very essential in states with low PIP limits, or where PIP is pricey.

cars insurance auto vehicle

cars insurance auto vehicle

Luckily, you can manage the price of your accident premium by selecting a high deductible (prices). Deductibles usually range from $50 as much as $2,000. The higher you decide for, the cheaper your costs will certainly be. Crash insurance is not mandatory from a lawful point ofview, yet if you lease your vehicle, the leasing firm may need that you hold this insurance coverage.

Little Known Questions About Full Coverage Auto Insurance - Moneygeek.

Is it actually worth it to pay a lot more for protection, that, by regulation, you are not required to have? Why you ought to obtain full protection In case of an accident, going with just liability insurance policy and also abandoning the "first-party" benefits of complete insurance coverage, indicates a long, unclear claims process where you have to take care of another insurance firm instead of your very own. cheapest car.

Filing with another insurance firm also means requiring to show that the "at-fault" motorist, which in most cases, can be challenging to identify, and occasionally depends upon the state you remain in. Still, if it is pricey to obtain complete protection, is it also worth paying every one of that cash for something that is unlikely to take place? The short response is indeed.

What that means, is that if you were to enter an average accident, the damages can be around $3,100 worth. cheapest car insurance. If you were the at-fault driver too, you are mosting likely to require to spend for those problems yourself. If your car is your major methods of traveling as well, then it might influence just how you get to function, which can cost you also more in lost incomes. credit.

There is an inherent threat in hoping that someone else's insurance policy will be able to cover that sum total. Not to state it can take weeks or months prior to you really see a pay for your clinical costs if you undergo one more vehicle driver's insurance firm (cheapest car). A minimum of with PIP, you understand for particular you are covered to a certain quantity and also can see settlement as quickly as you submit the claim.

There are several points you can do that can conserve you on your yearly costs. The initial is to regulate your deductible on your crash and extensive coverage. As we mentioned above, the. If you reserve some money in your cost savings account for your insurance deductible, maybe you can elevate it a little bit as well as therefore have less complicated regular monthly repayments.

Not known Facts About Cheap Full Coverage Car Insurance

Insurance provider, particularly the large ones, have more than 20 discount rates for a variety of different factors. Whether you're a tested risk-free vehicle driver, a, have actually taken a motorists education and learning course, or you can bundle your car policy with an additional insurance coverage plan, the consolidated discount rates can save you more than 20% on your annual costs - vehicle.