If you have a $500 deductible, you pay $500, then your cars and truck insurance coverage company pays the continuing to be $6,500. When do you pay an insurance deductible for auto insurance?

An uninsured/underinsured driver insurance claim may have a deductible, depending on where you live. Uninsured motorist coverage deductibles have a tendency to be regulated by your state rather of you selecting the quantity.

Do I pay a deductible if I'm not at fault? If you remain in a collision that is not your mistake, you generally won't pay a deductible. This is due to the fact that you would certainly be suing versus the at-fault motorist's cars and truck insurance. Nevertheless, the process of choosing that is at fault might take some time. vehicle insurance.

You will certainly need to pay your insurance deductible in this circumstances, but if it's later on discovered that you're not at mistake for the accident, you can get a refund. There are a couple of other possibilities that may occur: Your insurance firm may choose to seek activity against the various other motorist's supplier to redeem their prices.

If you are not able to redeem your insurance deductible from your supplier, you can take the other driver to little claims court for the insurance deductible amount. Keep in mind, however, that the insurance deductible amount might not worth the moment. Vehicle insurance policy deductible vs. exceptional Deductibles and premiums are two kinds of payments you make to your auto insurance coverage company for coverage - auto.

Examine This Report on How To Choose The Right Car Insurance Deductible - Metromile

Just how high should my deductible be? The greater your automobile insurance coverage deductible, the lower your premium will be. cheapest auto insurance.

If you have sufficient money to cover a high insurance deductible in the occasion of a claim, you should go that path. This aids keep your annual premium reduced and also might possibly save you a great deal of cash over time, particularly if you don't have to submit a claim.

This is since the worth of your automobile might be around what you 'd need to pay out of pocket in case of a case, making a high deductible cost expensive. You can typically select from a series of deductible quantities. There are also some automobile insurance coverage with no insurance deductible, yet they're so expensive that they're typically not worth it (cheap car insurance).

Our very own research reveals that there isn't a significant result on your costs once you pass by a $750 deductible, so think about keeping your insurance deductible amount in between $500 and also $1,000. It needs to be kept in mind that if you fund or lease your cars and truck, you may not have a selection in the insurance deductible on your vehicle insurance coverage plan.

LLC has made every initiative to ensure that the details on this website is correct, but we can not guarantee that it is complimentary of errors, mistakes, or omissions. All content and also solutions given on or via this site are given "as is" and "as available" for usage.

The Buzz on What Is An Auto Insurance Deductible? How Does It Work ...

A vehicle insurance coverage deductible is one of the most important factors to consider when picking coverage for your vehicle. cars. Since your deductible will certainly influence your monthly costs as well as the amount you'll pay for problems after making a claim, it's critical you choose carefully.

If your problems exceed your insurance deductible, the insurer will certainly cover the staying equilibrium up to your insurance coverage quantity. You choose your deductible amount as well as your insurance coverage limits, and are required to compensate to the deductible quantity prior to your insurer action in to cover the rest. For instance, allow's claim you select an insurance plan with a $1,000 deductible.

There are two major types of car insurance policy coverages that usually include deductibles:: This protection aids spend for damage to your lorry if it strikes an additional vehicle or things, is struck by one more cars and truck, or rolls over. perks.: This coverage helps spend for damages to your car that are not triggered by a collision.

If you have a $500 deductible and the damages to your auto total $450, you would pay the complete $450. If the problems to your automobile overall $1,000, you would certainly pay your $500 insurance deductible, and the insurance coverage company would cover the staying $500.

Nonetheless, if a chauffeur hits your lorry and both you and the other motorist are determined to be at fault, then you may be liable for paying at least a portion of your insurance deductible if you sue with your own insurer. You hit one more vehicle driver's car (vans). If you strike somebody else's car and also in doing so, damage your auto, your insurance business generally will pay for the problems to your vehicle, and also you will certainly be accountable for paying the deductible.

Michigan's Auto Insurance Law Has Changed Things To Know Before You Buy

Depending on your plan, you might have to pay a deductible. Once again, consult your insurance coverage agent to verify what your protection will certainly do. Your car was harmed in a hit-and-run. If you have collision or uninsured/underinsured motorist insurance coverage as well as somebody hits your vehicle as well as takes off the scene, you likely will be in charge of paying your deductible (cheapest car insurance).

Essentially, the extra costly your vehicle, the extra it costs to insure. That can translate into higher savings if you select a high insurance deductible. A number of aspects impact the price of your vehicle insurance coverage, but your deductible will have an effect Click here for more on your premiums as well as on just how much you'll pay out-of-pocket for damages to your cars and truck from a mishap. automobile.

Ideally you might never deal with a scenario where you'll have to pay a deductible, however it is essential that you be careful to select a plan with an insurance deductible that you can pay for to pay. Your insurance policy representative can help you address your deductible concerns. Get in touch with Travelers for your automobile insurance coverage quote.

Here are 10 means to minimize your car insurance. No person suches as to spend more money than essential on car insurance policy. These five tips can help reduced auto insurance prices. Picking cars and truck insurance coverage is a difficult task provided the abundance of providers and coverage options.

The money we make assists us provide you access to free debt ratings and reports and assists us create our various other excellent devices as well as educational materials. Settlement might factor into how and where products show up on our platform (and also in what order). Given that we typically make money when you find an offer you like and obtain, we try to show you provides we think are a good match for you.

How Ma Auto Insurance Deductibles Work Can Be Fun For Anyone

Certainly, the offers on our system don't stand for all economic products around, but our objective is to reveal you as lots of great options as we can. Baffled about just how a car insurance policy deductible works? When looking for vehicle insurance, you'll likely find words "deductible" and might ask yourself just how it impacts you and your insurance coverage prices and when you'll actually require to utilize it.

Common car insurance policy deductible quantities are $250, $500 as well as $1,000. Fixings completed $5,000, and also you have a $500 insurance deductible.

A car insurance deductible isn't a solitary amount that you pay annually prior to solutions are covered, like you'll usually find with wellness insurance coverage deductibles. In other words, it depends upon where you live. In many states, if you remain in a mishap that's the other driver's fault, their liability insurance policy is typically liable for covering your repair work, up to the protection restriction.

Deductible specified An insurance deductible is an amount of money that you yourself are in charge of paying towards an insured loss. When a disaster strikes your residence or you have a cars and truck accident, the amount of the deductible is deducted, or "deducted," from your case repayment. Deductibles are the method which a danger is shared between you, the insurance policy holder, and also your insurance firm - cheapest car.

A deductible can be either a particular dollar amount or a portion of the total amount of insurance policy on a plan. insurance. The amount is established by the terms of your coverage and can be located on the declarations (or front) page of conventional homeowners and car insurance coverage. State insurance policy laws purely dictate the method deductibles are incorporated into the language of a policy and also just how deductibles are executed, as well as these laws can vary from state to state.

Facts About How Does Car Insurance Deductible Work? - Experian Uncovered

In case of the $10,000 insurance policy loss, you would be paid $8,000. In case of a $25,000 loss, your claim check would be $23,000. Keep in mind that with auto insurance or a homeowners plan, the deductible applies each time you file an insurance claim. The one significant exception to this is in Florida, where hurricane deductibles specifically are applied per season as opposed to for each tornado.

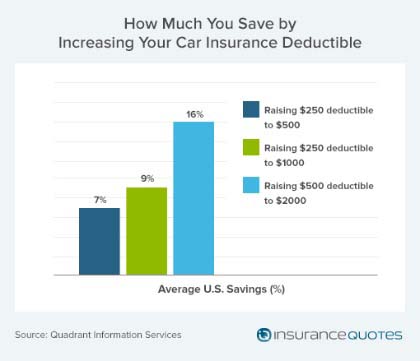

To use a a property owners plan instance, an insurance deductible would relate to residential property damaged in a rogue barbecue grill fire, yet there would certainly be no deductible versus the responsibility portion of the plan if a melted visitor made a clinical insurance claim or sued. Raising your deductible can conserve cash One method to save cash on a homeowners or automobile insurance coverage policy is to raise the deductible so, if you're looking for insurance policy, ask about the choices for deductibles when comparing plans - cheaper car insurance.

Going to a $1,000 deductible might save you also a lot more. Many house owners as well as renters insurers offer a minimal $500 or $1,000 deductible.

In some states, insurance holders have the alternative of paying a higher premium in return for a conventional dollar insurance deductible; nonetheless, in high-risk coastal areas insurers may make the portion deductible compulsory (auto). work in a comparable method to hurricane deductibles as well as are most typical in locations that commonly experience extreme cyclones as well as hailstorm.

Wind/hail deductibles are most commonly paid in portions, commonly from one to 5 percent. If you haveor are considering buyingflood insurance coverage, make certain you understand your deductible. Flooding insurance deductibles differ by state and also insurer, and are readily available in buck amounts or percents. You can select one deductible for your residence's framework and one more for its components (note that your mortgage firm may call for that your flooding insurance coverage deductible be under a specific quantity, to assist ensure you'll be able to pay it).

The Greatest Guide To How To Choose Your Auto Insurance Deductibles - Rates.ca

Insurers in states that have greater than average threat of earthquakes (for instance, Washington, Nevada as well as Utah), usually established minimum deductibles at around 10 percent. cheaper car insurance. In California, the standard California Quake Authority (CEA) policy includes an insurance deductible that is 15 percent of the substitute price of the primary residence framework and starting at 10 percent for additional coverages (such as on a garage or other outbuildings).